In the world of manufacturing, the winds of change are blowing with increasing velocity, driven by the digital transformation revolution. This transformation is not just a fleeting trend but a fundamental shift in how manufacturing businesses operate, especially in the realm of sales. For manufacturer sales representatives, digital tools are no longer just an option but a necessity to stay competitive and efficient.

We will explore key statistics and trends that paint a vivid picture of how digitalization is reshaping the landscape of manufacturer sales. From the integration of advanced technologies to the evolving role of sales representatives, this exploration aims to provide a comprehensive understanding of the digital transformation journey in the manufacturing sector.

The Current State of Digital Transformation in Manufacturer Sales

The manufacturing sector, traditionally seen as a bastion of physical labor and tangible products, is now at the forefront of digital adoption. This shift is driven by the need to meet changing market demands, improve operational efficiency, and enhance customer engagement. Digital tools in manufacturing range from customer relationship management (CRM) systems, quoting software, and data analytics platforms to advanced technologies like AI and machine learning.

Key Statistics on Digital Integration in Sales Processes

The manufacturing industry has seen a significant uptick in the adoption of digital tools in sales processes. For instance, a report by McKinsey & Company highlighted that B2B companies, including those in manufacturing, saw digital interactions with clients jump to 70-80% during the pandemic, a trend that is likely to continue.

This shift is not just about adopting new technologies but also about transforming sales strategies to be more data-driven and customer-centric. Here are some of the key findings:

- 97% of sales teams use at least one digital selling tool, and about two-thirds of sales teams use between 4 and 10 digital selling tools as part of their sales tech stacks. (Source)

- A Gartner research on digital sales rooms claims digital channels will be used for 80% of supplier-to-buyer interactions in business by 2025. (Source)

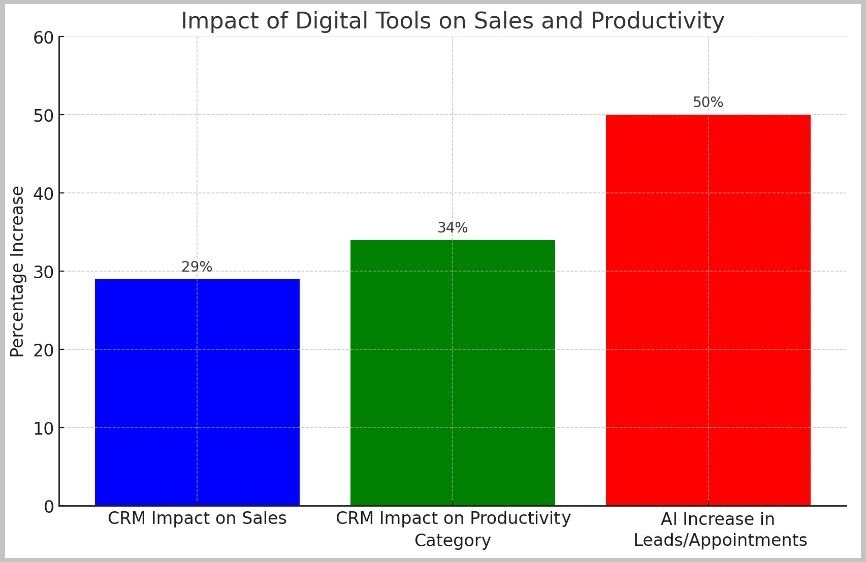

- CRMs can boost sales by 29% and productivity by 34% (Source)

- Sales reps spend just 28% of their week actually selling, with the majority of their time consumed by other tasks like deal management and data entry. (Source)

The rate of digital adoption in manufacturer sales has accelerated notably in recent years. Pre-pandemic, the adoption was more gradual, focused on streamlining operations and enhancing traditional sales channels.

However, the pandemic served as a catalyst, fast-tracking digital transformation. Companies that were hesitant to embrace digital tools found themselves rapidly adopting e-commerce platforms, virtual sales meetings, and digital customer service channels to survive and thrive in the new normal.

Key Digital Tools Reshaping Manufacturer Sales

The landscape of manufacturer sales is being reshaped by a suite of digital tools, each playing a pivotal role in enhancing sales strategies and customer engagement.

CRM Software

Customer Relationship Management (CRM) software stands at the forefront of this digital revolution. These systems enable sales representatives to manage customer interactions more effectively, track sales pipelines, and forecast sales trends. A leading CRM software company reported that their customers saw an average increase in sales revenue by 37%.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming sales by providing predictive analytics, customer behavior insights, and personalized recommendations. A study by McKinsey noted that businesses adopting AI in sales reported up to a 50% increase in leads and appointments.

- Artificial intelligence (AI), paired with automation, removes busywork like updating deal records and scoring leads, so sellers can focus on conversations with buyers. High-performing reps are 1.9x more likely to use AI. (Source)

Internet of Things (IoT)

IoT technology is revolutionizing manufacturer sales by enabling real-time data collection and analysis. This leads to improved product tracking, inventory management, and predictive maintenance. A report by PwC indicated that 35% of manufacturing companies adopted IoT to enhance operational efficiency.

- Approximately 60% of manufacturers report improved customer satisfaction as a result of digital transformation initiatives. (Source)

Quoting and Quote Management Software

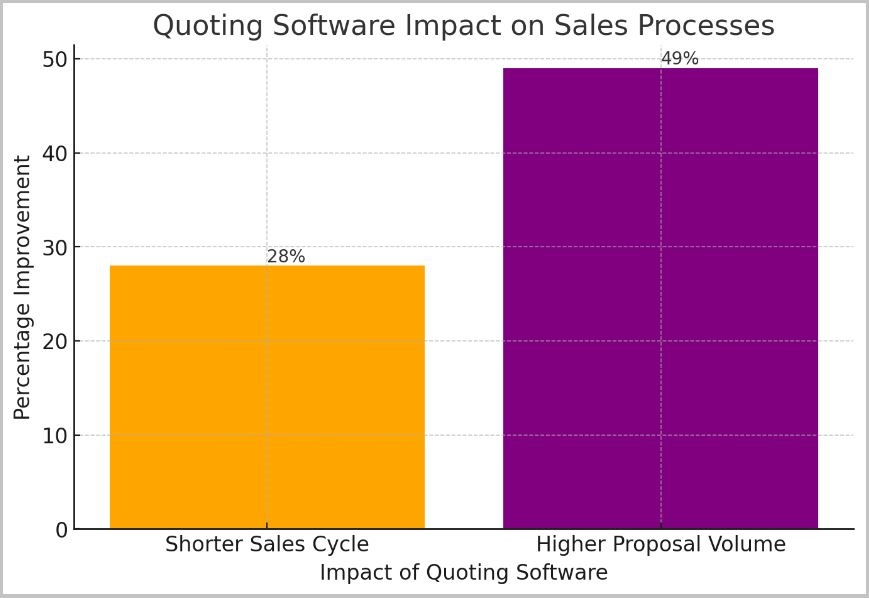

Quoting and quote management software is becoming increasingly crucial in manufacturer sales. This software streamlines the process of creating, sending, and tracking quotes, making it easier for sales teams to manage complex pricing structures and discounts. It also enhances accuracy in pricing and speeds up the approval process. A study by Aberdeen Group found that companies using automated quoting tools experienced a 28% shorter sales cycle and 49% higher proposal volume.

- It is reported that it takes 20 to 40 minutes for starters to create a quote on average, and online sales quoting software cuts sales cycles by 28% and approval time by 95% (Source)

Investment in Digital Technologies

Investment in digital technologies within the manufacturing sector has seen a steady increase. According to a report by Deloitte, manufacturers are expected to spend approximately 5% of their revenues on digital technologies.

Regional and Industry-Specific Patterns

North America and Europe lead in digital technology investments, primarily driven by the need for operational efficiency and competitive differentiation.

- Digital adoption rates are lower in Europe than in the US, with only 66% of manufacturing firms in the EU reporting having adopted at least one digital technology, compared to 78% in the US. (Source)

- The digital transformation market in manufacturing is expected to reach $642.35 billion by 2025. (Source)

- In 2020, North American banks were expected to spend up to 40% of their IT budget on new technology, while European banks invested less. (Source)

- Europe’s ecosystem of digital companies has grown twice as fast as in the US during the past seven years, and funding in Europe’s private companies eclipsed $100 billion for the first time in 2021. (Source)

Industries like automotive, HVAC, and aerospace are at the forefront, leveraging digital tools for complex product sales and lifecycle management.

Impact of Digital Transformation on Sales Efficiency

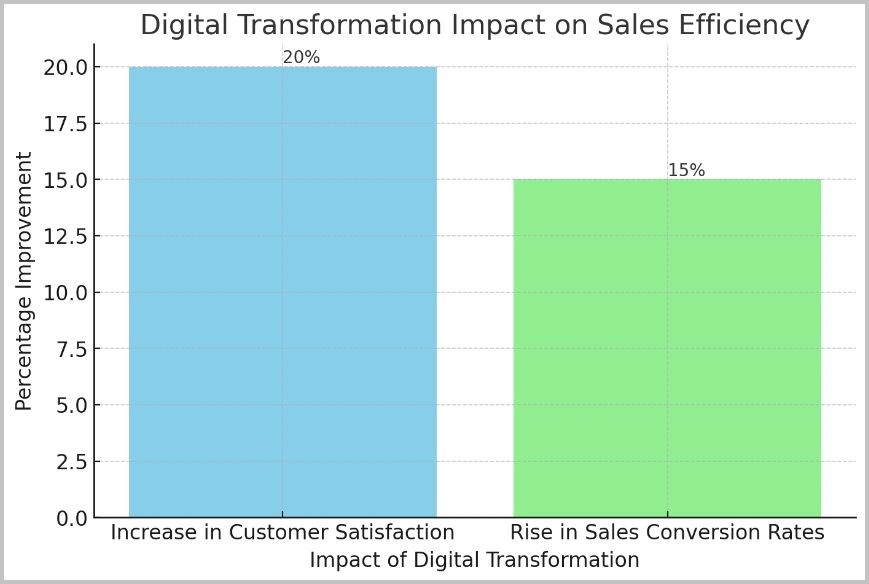

Digital transformation has significantly impacted sales efficiency. A study by Accenture revealed that companies implementing digital sales strategies witnessed a 20% increase in customer satisfaction and a 15% rise in sales conversion rates.

- By analyzing customer behavior, segmenting buyers, and tailoring strategies accordingly, organizations can streamline their efforts and achieve an 18% increase in overall sales without additional headcount. (Source)

- Companies leveraging CRM systems have seen an increase in sales productivity by up to 34% and a reduction in sales cycle duration by 14%. (Source)

Digital tools have streamlined sales processes by automating routine tasks, enabling faster response times, and providing real-time data for informed decision-making. This has led to shorter sales cycles and improved customer experiences.

Challenges and Barriers in Adopting Digital Tools

Despite the benefits, manufacturers face challenges in adopting digital tools. The most common challenges include budget constraints, resistance to change, inefficient data management, and a lack of digital skills among the workforce.

- 43% of manufacturers cited budget constraints as a major barrier to digital transformation, while 37% pointed to a lack of internal expertise. (Source)

- An IBM study estimated that bad data management cost the U.S. economy $3.1 trillion due to overall lowered employee productivity and costs associated with data maintenance. (Source)

- 90% of companies have experienced data loss due to a lack of proper data management. (Source)

- Poor data management practices can reduce a company’s operational efficiency by 21%. (Source)

- Data overload leads to inefficiencies and missed opportunities, with 88% of data being ignored by businesses and only 14% of companies having data widely accessible to employees. (Source)

- Inefficient data management leads to poor decision-making and lost revenue, with 80% of those surveyed admitting they have to rebuild data. (Source)

- The financial impact of poor data quality on organizations averages around $9.7 million each year. (Source)

To overcome these challenges, manufacturers can focus on upskilling their workforce, seeking partnerships for technological expertise, and implementing phased digital adoption strategies to assist with data management and manage costs.

Future Trends and Predictions

The future of digital transformation in manufacturer sales is promising and dynamic. Technologies like 5G, Artificial Intelligence (AI), and Machine Learning (ML) are set to play a significant role in the future of manufacturer sales.

- Companies are experimenting with new technologies, with the top three being 5G 27%, digital twins 24%, and robotic process automation 20%. (Source)

- Almost 90% of organizations worldwide had implemented cloud technologies as of 2022, the highest adoption rate of any emerging technology. (Source)

- Global digital transformation spending is projected to reach $1.6 trillion in 2022, and it is predicted to double over the next four years, reaching $7 trillion by 2023. (Source)

- Digital transformation could reach $100 trillion in societal and industrial value by 2025. (Source)

- 76% of companies are investing in emerging technologies, and in 2023, companies will continue to invest in technologies like artificial intelligence (AI), the Internet of Things (IoT), cloud computing, big data and analytics, and blockchain. (Source)

Based on current trends, there is an expected increase in the use of AI for predictive sales analytics and a greater emphasis on customer experience management through digital tools.

These trends are likely to lead to more personalized customer experiences, faster sales cycles, and increased operational efficiency.

Not Just a Trend But a Strategic Imperative

In conclusion, digital transformation in manufacturer sales is not just a trend but a strategic imperative. The key statistics and trends discussed highlight the significant benefits and challenges associated with this transformation.

As we move forward, it is crucial for manufacturer sales representatives and industry players to embrace these digital tools and strategies. The future of manufacturing sales lies in the ability to adapt, innovate, and leverage the power of digital technologies to stay competitive and meet evolving market demands.

Digital Transformation in Manufacturer Sales FAQs

The digital transformation market in manufacturing is substantial and growing rapidly. As of January 2022, the market was projected to reach several hundred billion dollars in the next few years. For instance, a report by Statista estimated that the global digital transformation spending in the manufacturing sector would surpass $600 billion by 2023. This growth is fueled by the increasing adoption of technologies like AI, IoT, and cloud computing across the manufacturing industry.

Digital transformation significantly influences the manufacturing industry by enhancing efficiency and productivity through automation, improving quality control with AI and machine learning, optimizing supply chains for cost reduction and better delivery, allowing greater product customization and flexibility, and enabling data-driven decision-making for strategic planning.

Regarding digital transformation statistics, a McKinsey survey revealed that 92% of companies expect to modify their business models due to digitalization. IDC projected a 10.4% growth in global digital transformation spending in 2020, reaching $1.3 trillion. Deloitte’s report showed that digitally mature companies are 23% more profitable than their less advanced counterparts.

In the realm of sales, digital transformation leads to increased efficiency through tools like CRM and AI analytics, enhancing customer experiences for greater satisfaction and loyalty, and enabling data-driven sales strategies. It also expands market reach by tapping into new segments and provides agility in sales operations to swiftly respond to market and customer demands.